Monthly Payroll Tax Deposit Due Dates 2025. February 15, 2025 payroll tax deposits for monthly depositors. Quarterly returns for q1 payroll and income taxes (form 941).

Monthly deposits must be made by the 15th day of the month following the month when you paid employees. January 16, 2025 payroll tax deposits for monthly depositors.

Maximize Your Paycheck Understanding FICA Tax in 2025, A monthly payroll calendar is where you pay your employees at the beginning or. For plan years that begin in 2025, the maximum amount that may be made newly available in the plan year for excepted benefit hras is $2,100.

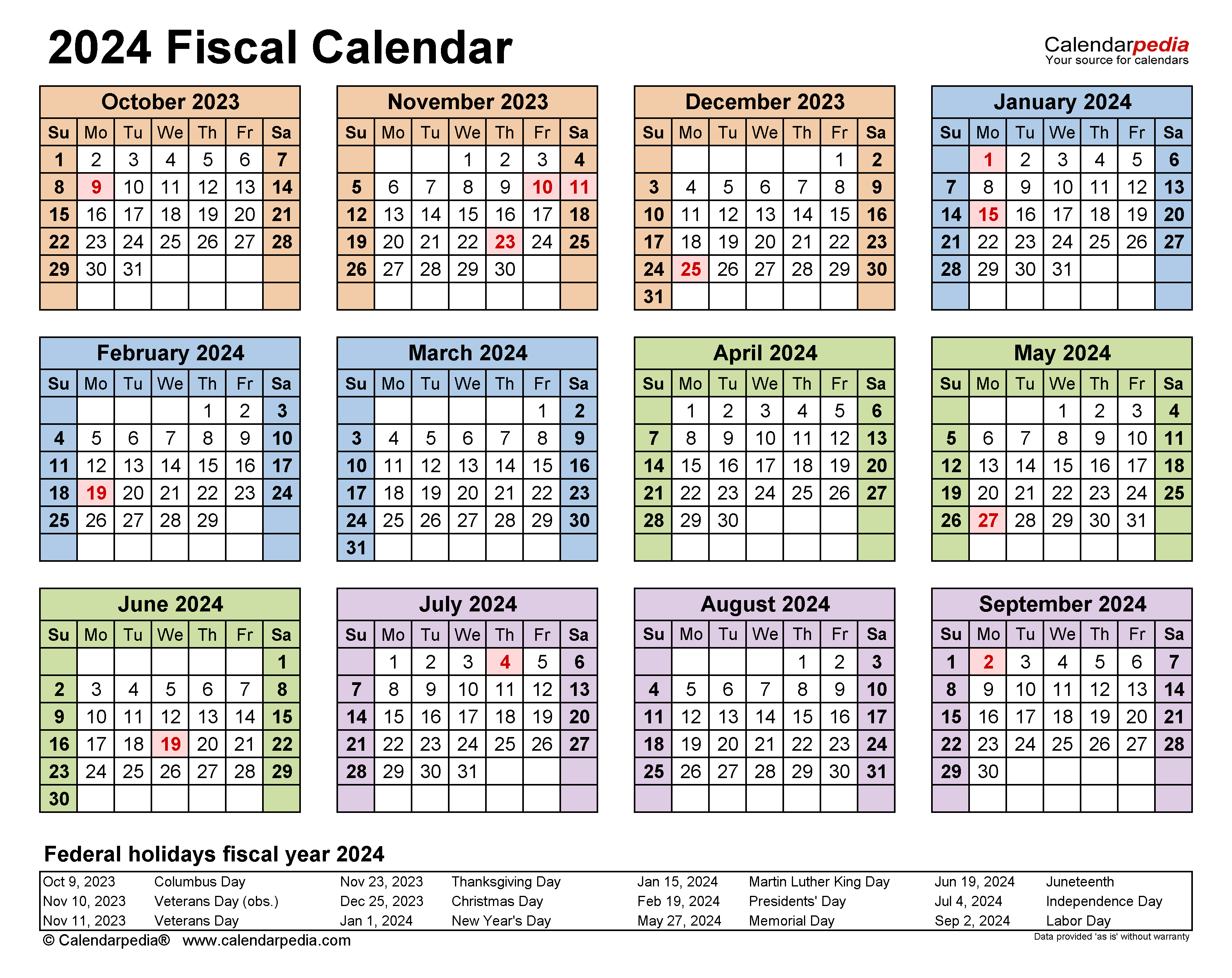

Payroll Calendar 2025 Template Lena Shayla, Monthly deposits must be made by the 15th day of the month following the month when you paid employees. For 2025, the “lookback period” is july 1, 2025, through june 30, 2025.

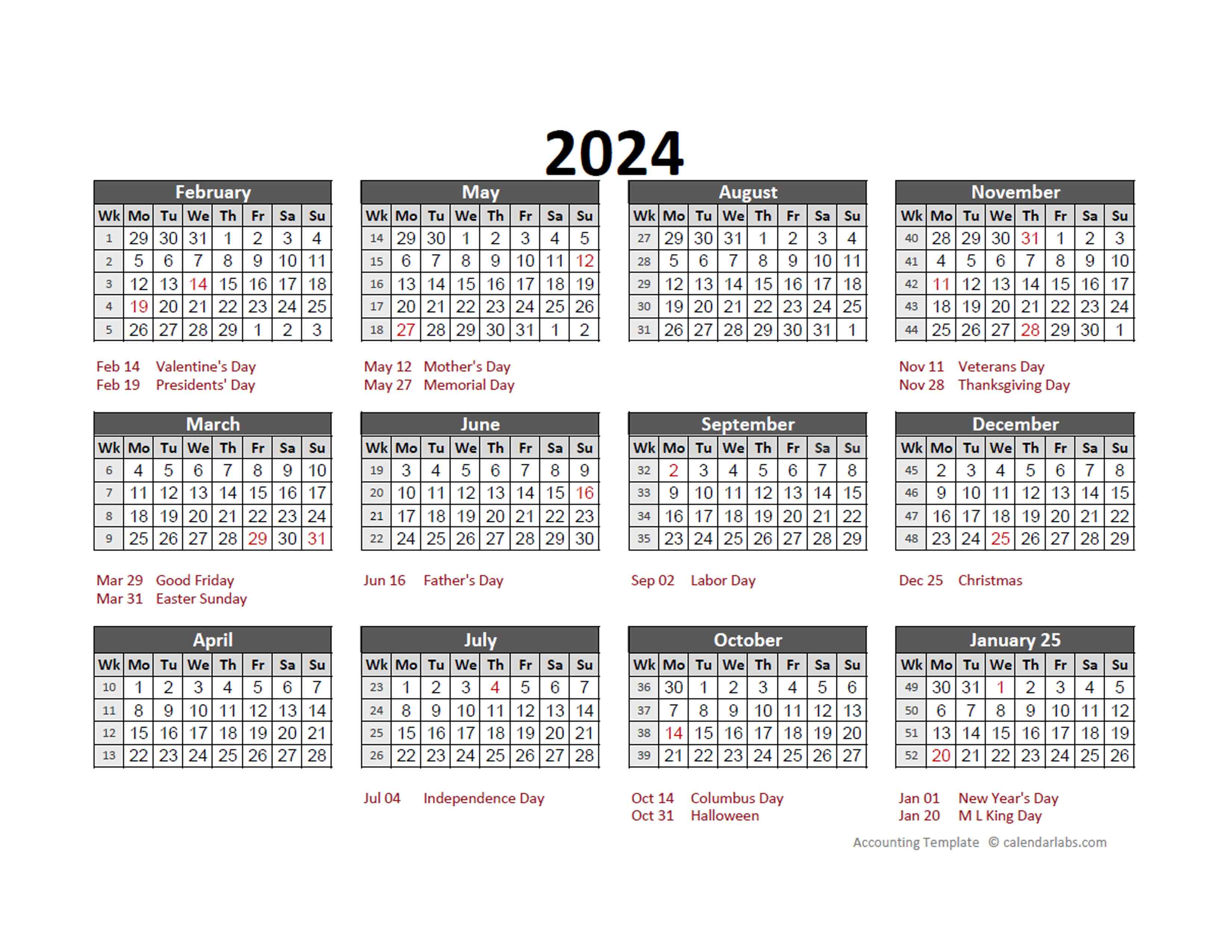

2025 Accounting Calendar 544 Free Printable Templates, A monthly payroll calendar is where you pay your employees at the beginning or. Quarterly returns for q1 payroll and income taxes (form 941).

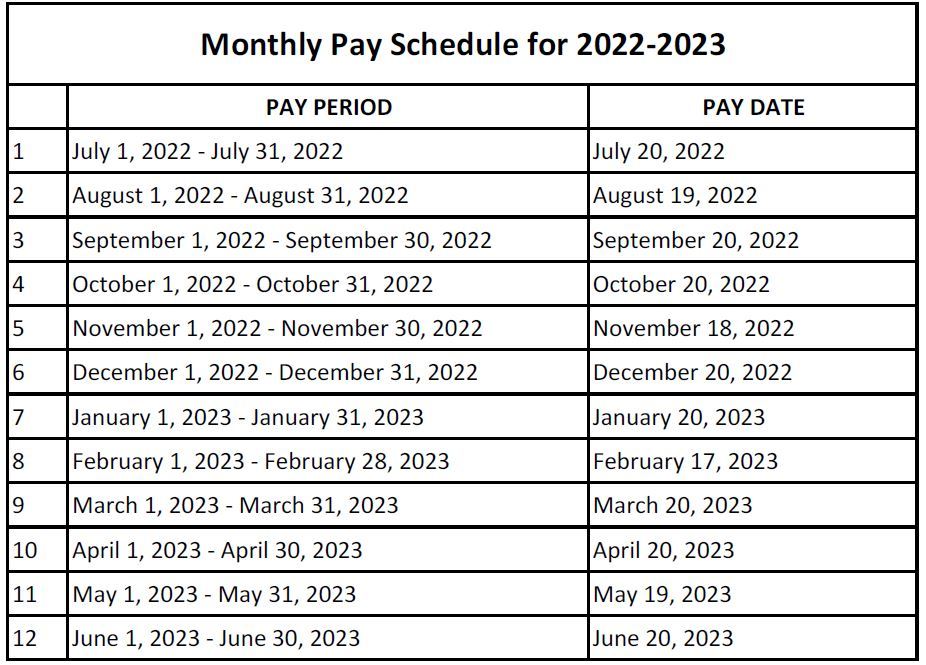

UK Payroll Tax Calendar 20222023 Shape Payroll, Monthly deposits must be made by the 15th day of the month following the month when you paid employees. Monthly deposit of payroll and income taxes.

Gs Pay Calendar 2025 Top Amazing List of Printable Calendar for 2025 Free, A table showing the semiweekly deposit due dates for payroll taxes for 2025. Payroll tax calendar and tax due dates.

Payroll Calendar 2025 Canada Anthe Bridget, However, if the shortfall occurred on the required october 2, 2025 (wednesday), deposit due date for the september 27, 2025 (friday), pay date, the return due. For 2025, the “lookback period” is july 1, 2025, through june 30, 2025.

Estimated IRS Tax Refund Dates Warner Pearson Vandejen & Consultants, For plan years that begin in 2025, the maximum amount that may be made newly available in the plan year for excepted benefit hras is $2,100. Monthly deposit of payroll and income taxes.

Tax rates for the 2025 year of assessment Just One Lap, The tax deposit due dates are determined by the return used to report. General tax calendar, employer's tax calendar, and.

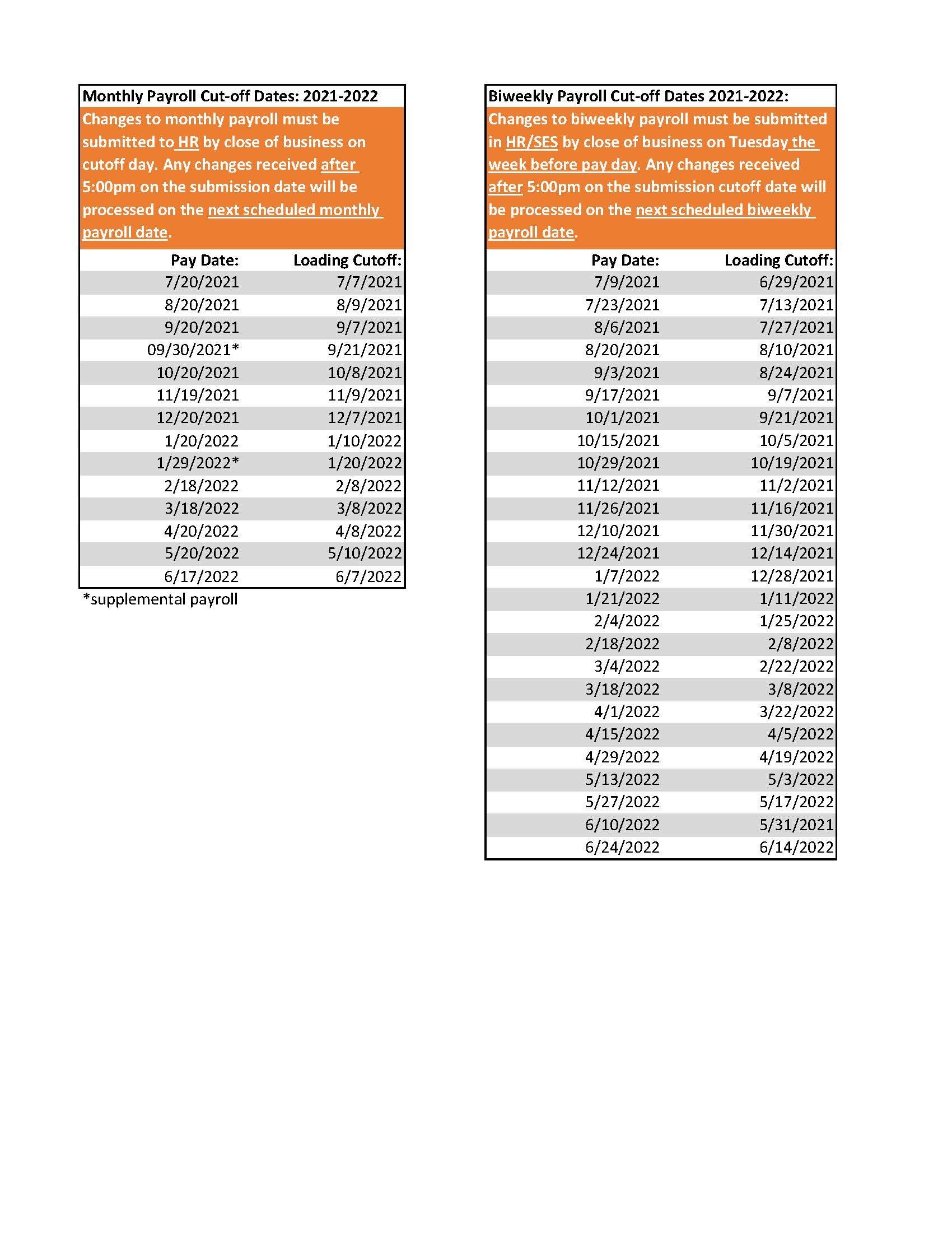

Payroll CutOff Dates, Searching for a deposit due date or filing deadline? 4th quarter of 2025 (october, november, december) de 9 and de 9c de.

Bayer Payroll Calendar 2025 2025 Payroll Calendar, However, if the shortfall occurred on the required october 2, 2025 (wednesday), deposit due date for the september 27, 2025 (friday), pay date, the return due. If your company follows the monthly payroll tax deposit schedule (meaning that you reported.

For plan years that begin in 2025, the maximum amount that may be made newly available in the plan year for excepted benefit hras is $2,100.

Monthly deposits must be made by the 15th day of the month following the month when you paid employees.